Swiss citizens will soon vote on a proposal to abolish the rental-value tax charged to homeowners. Yet important facts about the proposed reform are being drowned out in the typical political bickering between left and right. In this article, we take an objective look at what the proposal would mean in practice and who the winners and losers would be. Our view is that a large majority of homeowners would be better off keeping the status quo.

On 28 September 2025, the final step in a long political battle will take place as Swiss voters decide whether to abolish the rental-value tax charged to homeowners. The tax was initially introduced to level the playing field between homeowners and renters, but homeowners believe it’s unfair because it artificially inflates their income – and therefore their tax bill. We first wrote about this proposal just over a year ago.

→ Read more: What homeowners should do before the rental-value tax is abolished

At that point, the details of the reform were still being hammered out in Swiss Parliament. But the two chambers have since reached an agreement and drafted the proposal that will be put to a vote early this fall in a public referendum.

What the tax reform would entail

The reform was initially intended to eliminate the rental-value tax. But because left-leaning parties saw that as a handout to the rich, clauses were added to offset the impact by getting rid of certain tax deductions.

- Home maintenance and renovation costs: these would no longer be tax-deductible, including for energy-efficiency and environmental renovations. However, this change would apply only at the federal level, as individual cantons could decide to keep the deduction in place.

- Mortgage interest payments: these would also stop being tax-deductible. An exception would be made for first-time home buyers, but the deductions would be sharply capped at an amount that decreases linearly: CHF 10,000 the first year, CHF 9,000 the second year and so on until the cap reaches zero, for an average of CHF 5,000 per year for 10 years.

The tax reform in figures

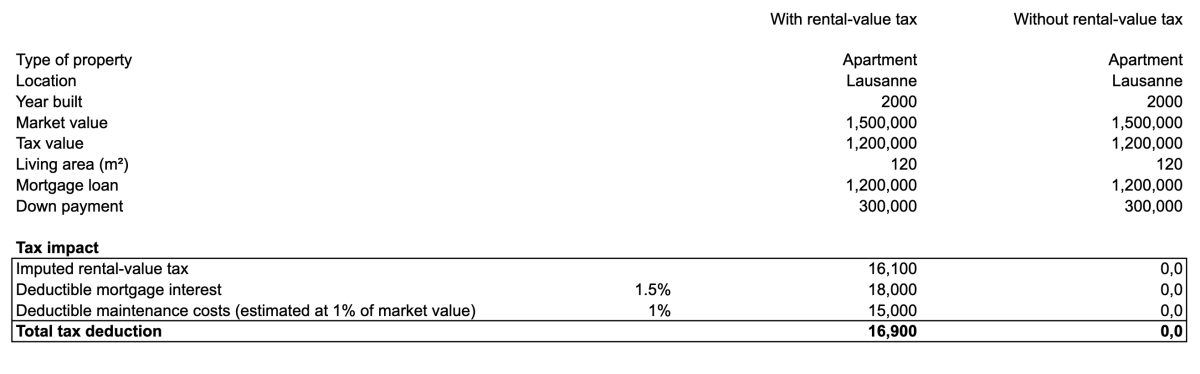

We’ve put together two examples to show how the tax reform would affect a homeowner’s overall tax bill under different scenarios.

In the first example, imagine you own a 120 m2 apartment in Lausanne that you bought for CHF 1.5 million.

Under the current system, your rental-value tax would be CHF 16,100. But that amount would be more than offset by the deductions for home maintenance and mortgage interest, which together amount to CHF 33,000. We calculated the home maintenance costs by estimating the actual amounts, which could be high if the apartment building has a custodian as well as large common areas, shared equipment and outdoor areas that require upkeep, for example. The rate of 1% of market value used in our calculation is the same rate used by banks when evaluating mortgage applications.

Putting all these numbers together, you would end up with a CHF 16,900 tax deduction.

If the tax reform is approved in the referendum, you would no longer have to pay the CHF 16,100 rental-value tax – but don’t get excited just yet! At the same time, your home maintenance and mortgage interest deductions would also disappear. As a result, your taxable income would end up being CHF 16,900 higher. That’s not such a good deal.

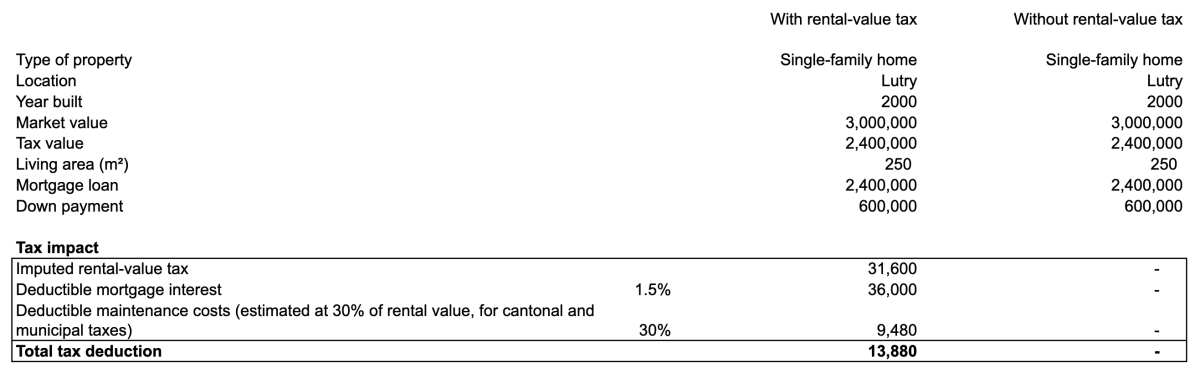

In the second example, suppose you own a 250 m2 single-family home in Lutry for which you paid CHF 3 million.

Here, the rental-value tax would be considerably higher, at CHF 31,600, owing to the larger surface area. But that’s more than offset by the home maintenance and mortgage interest deductions, which total CHF 45,480. In this case, we calculated the maintenance costs on a flat-rate basis since the estimated actual costs would probably be lower. This rate was set at 30% because the house is more than 20 years old.

Putting all these numbers together, you would end up with a CHF 13,880 tax deduction.

If the tax reform is approved, however, your home maintenance and mortgage interest deductions would disappear – leaving you with CHF 13,880 of additional income to pay taxes on.

In both of these examples, which come from Vaud Canton, the current system would be better for you than the proposed change. In fact, the mortgage interest deductions alone are greater than the rental-value tax. It’s also worth noting that mortgage interest largely exceeds the CHF 10,000 amount that would still be deductible for first-time home buyers in the first year – and that would decrease by CHF 1,000 per year to reach zero after 10 years.

The winners of the proposed reform

In these examples, we assumed a low down payment and a consequently high mortgage. This is realistic given the elevated property prices across much of Switzerland. Of course, a smaller mortgage would result in a lower interest deduction, and the deduction would decrease as more of the mortgage is paid off. But in our first example, you would still be better off under the current system even after you’ve paid off 90% of your mortgage! In the second example, you’d be better off until you’ve paid off 50%.

In the end, not many homeowners can really afford to carry such little debt. And even for those who can, it’s not necessarily a good idea to keep so much money tied up in their home instead of investing it elsewhere. The Swiss tax system is currently designed to encourage investment – and this is one of the reasons behind our prosperity. Why should we jeopardize the country’s economic growth?

There’s another drawback to the proposed reform: it could prompt homeowners to scale back their maintenance and renovation spending, with potentially damaging consequences for the construction sector and for the quality of Swiss real estate.

Lastly, the reform could make things harder for homeowners if interest rates go up, since mortgage interest would no longer be tax-deductible.

Bad idea for homeowners – and Switzerland

On its own, abolishing the rental-value tax would be good news for homeowners. But it would come at a heavy cost! An objective view of the proposed reform shows that it would be detrimental to most homeowners because it would do away with important tax deductions. And that’s true for homeowners both now and in the future, unlike what many backers of the reform have claimed.

Our analysis suggests that for the vast majority of homeowners, voting in favor of the reform would be tantamount to shooting themselves in the foot. They’d be better off casting a No vote on 28 September.

But even beyond the figures, the reform is based on the idea of encouraging Swiss homeowners to keep a lot of money parked in their homes, which we feel is counterproductive. In our view, Switzerland’s economy will be better off if we keep today’s investment-friendly mindset – and system – in place.